Background.

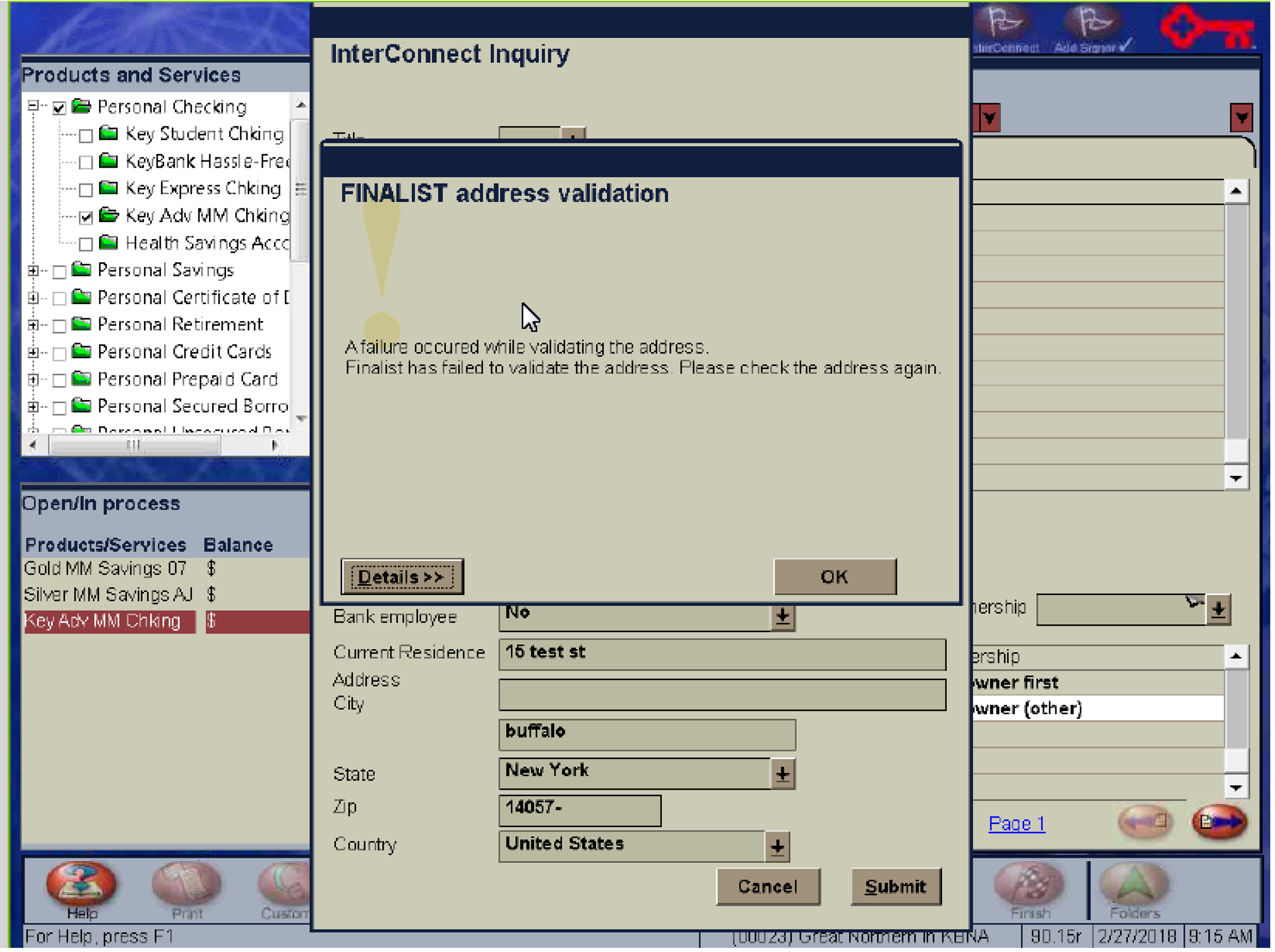

"I lost a $75,000 direct deposit client because Key Counselor crashed mid-way and I couldn't get it to work. Client left the branch frustrated."

48 yrs, Branch manager, April 2018

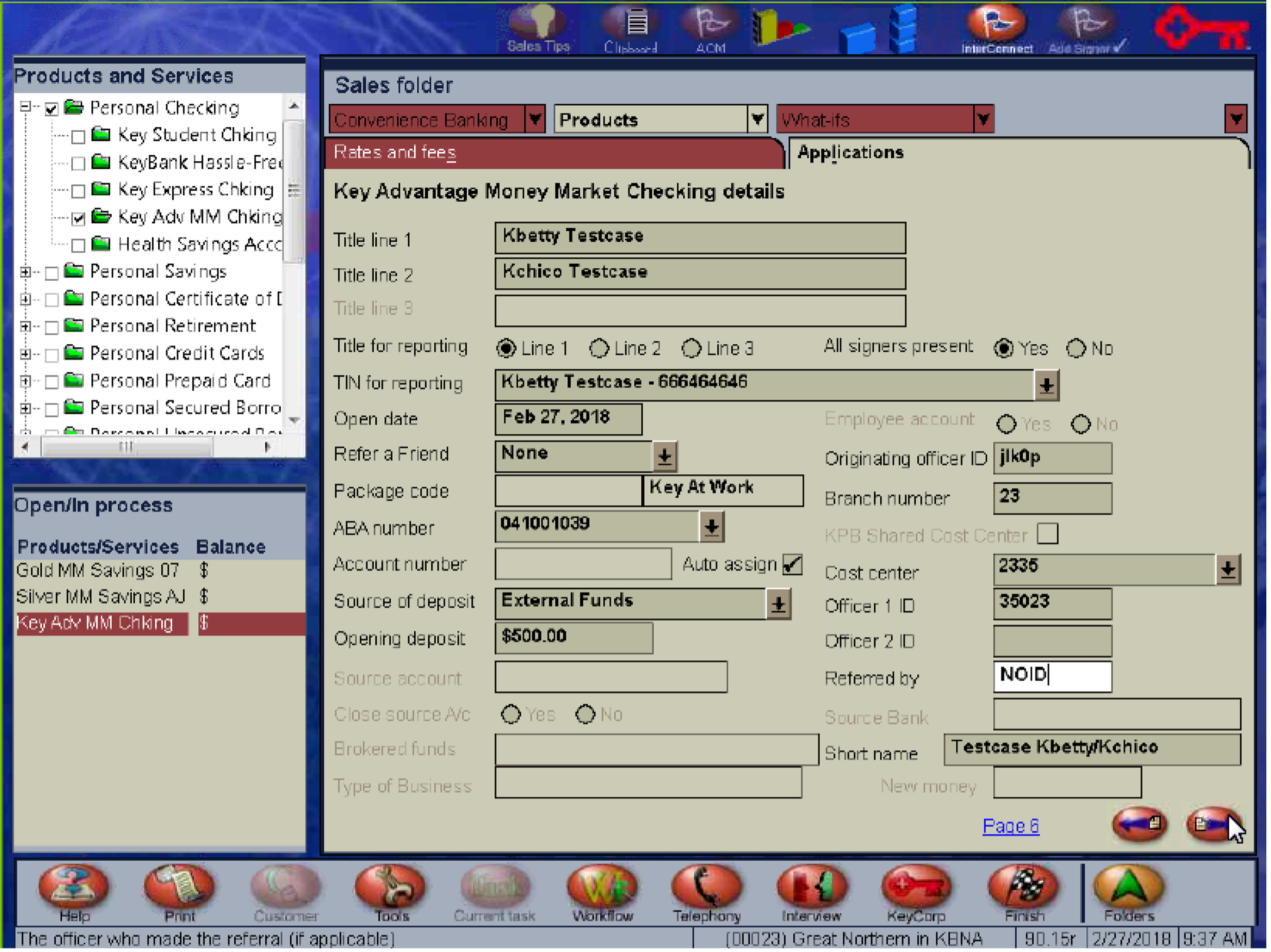

The average time it took for Keybank customers to open a deposit account in-branch was 55 minutes. The process was excruciatingly slow and unreliable resulting in several customers taking their business to another bank. Since 51% of their prospective and 63% of their existing customers preferred going to a branch to open accounts, Keybank was losing money.

Additionally, Keybank leadership wanted to streamline account opening experience into one overall flow that can replace their then disparate online and in-branch experience.

Project goals.

The ask from Keybank executives was to bring the average account opening time in-branch to under 15 minutes. Additionally, our UX proposal could also be scaled to a self service experience online.

Project was initiated on March of 2018 with a UX delivery timeline of 6 months during which I scoped competitor landscape, collaborated with business stakeholders plus branch managers to review their processes, and obtained alignment with Keybank's business and legal on design proposals. The entire effort resulted in the delivery of re-designed end-to-end flow that was then also extended to their online account opening flow.

Team.

UX Lead, UX Designer (me) & VX Designer

My responsibilities included cretaing interaction design flows, high-fidelity mock ups, prototyping, organizing leadership reviews, and usability testing.

Design & outcomes.

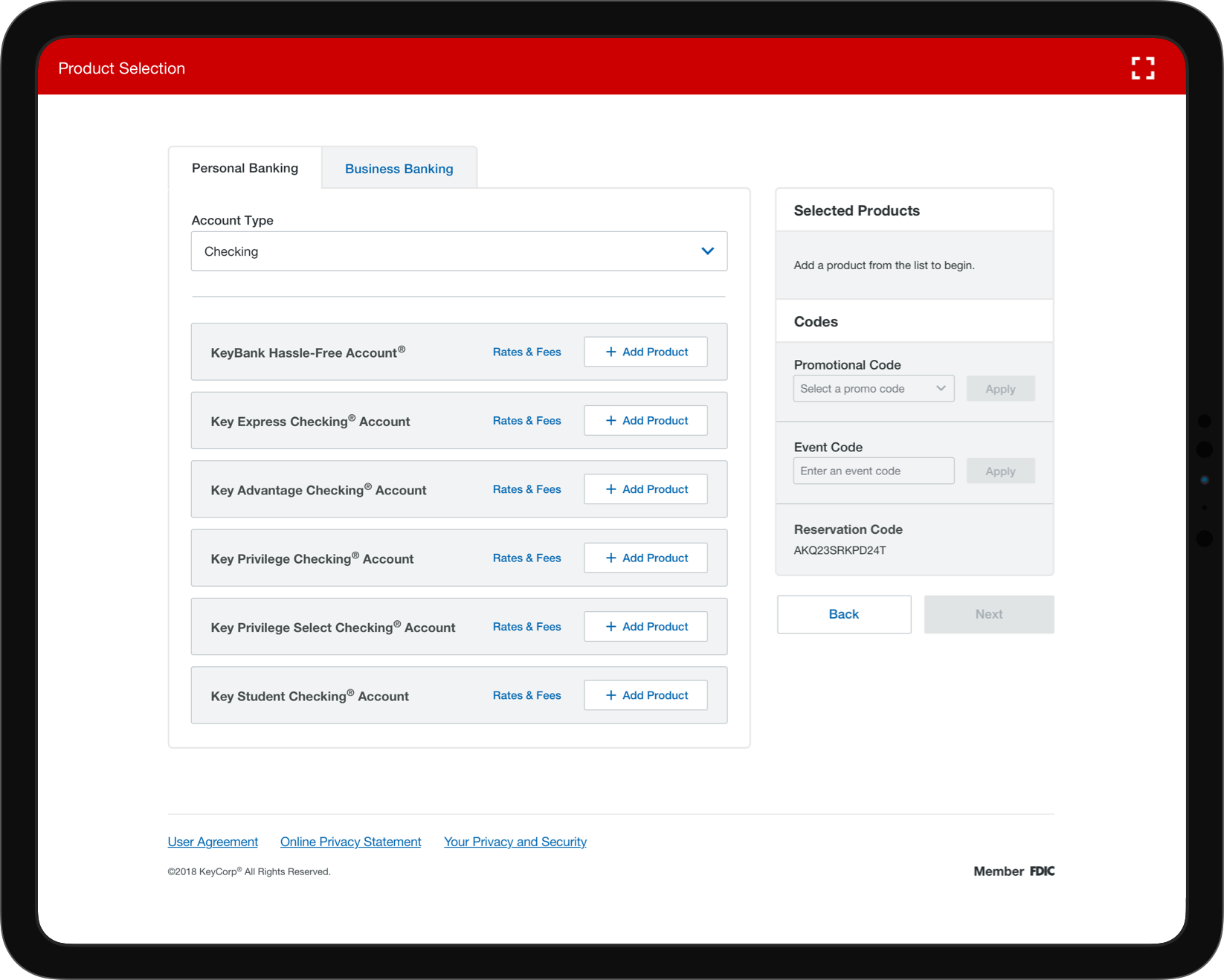

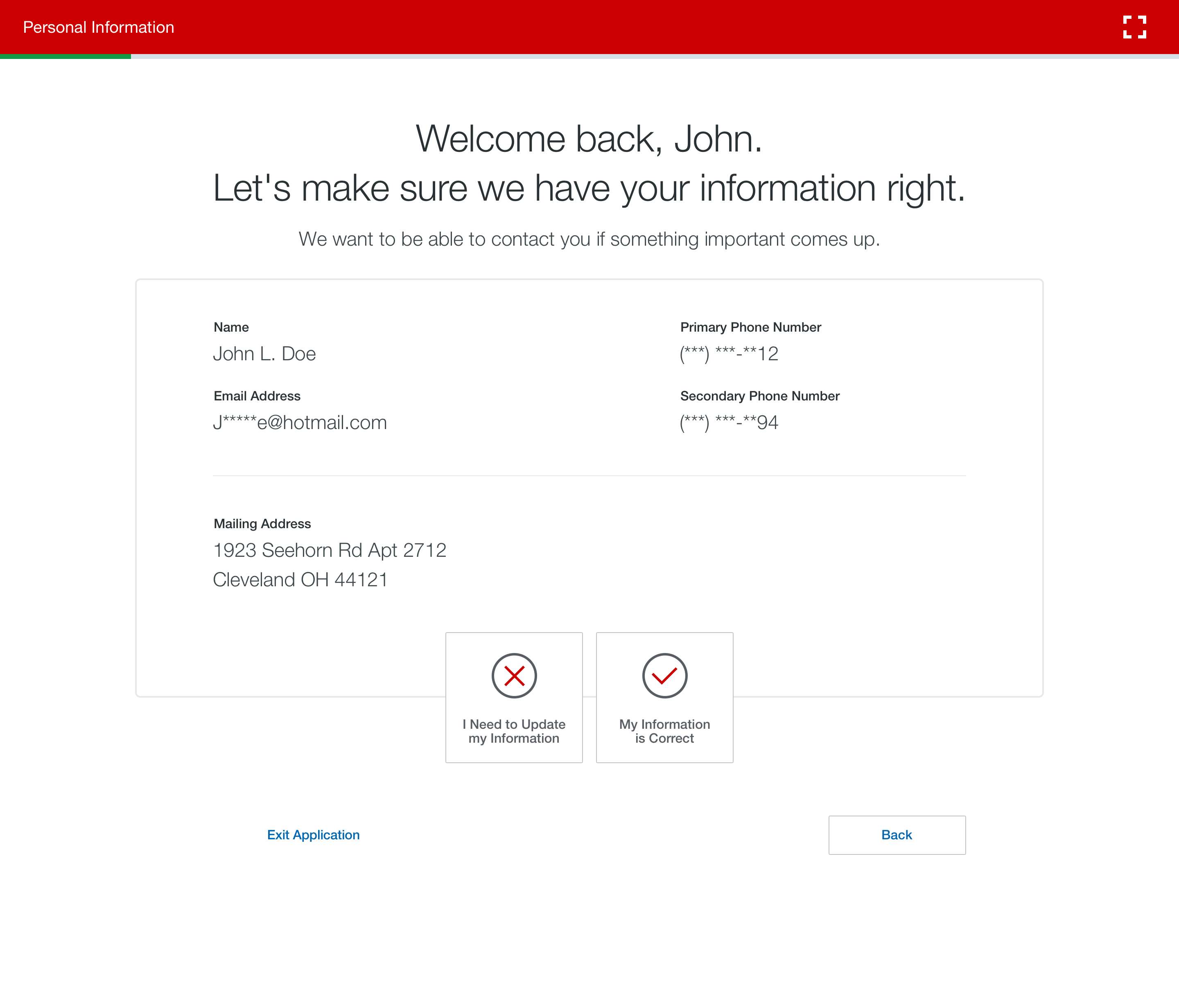

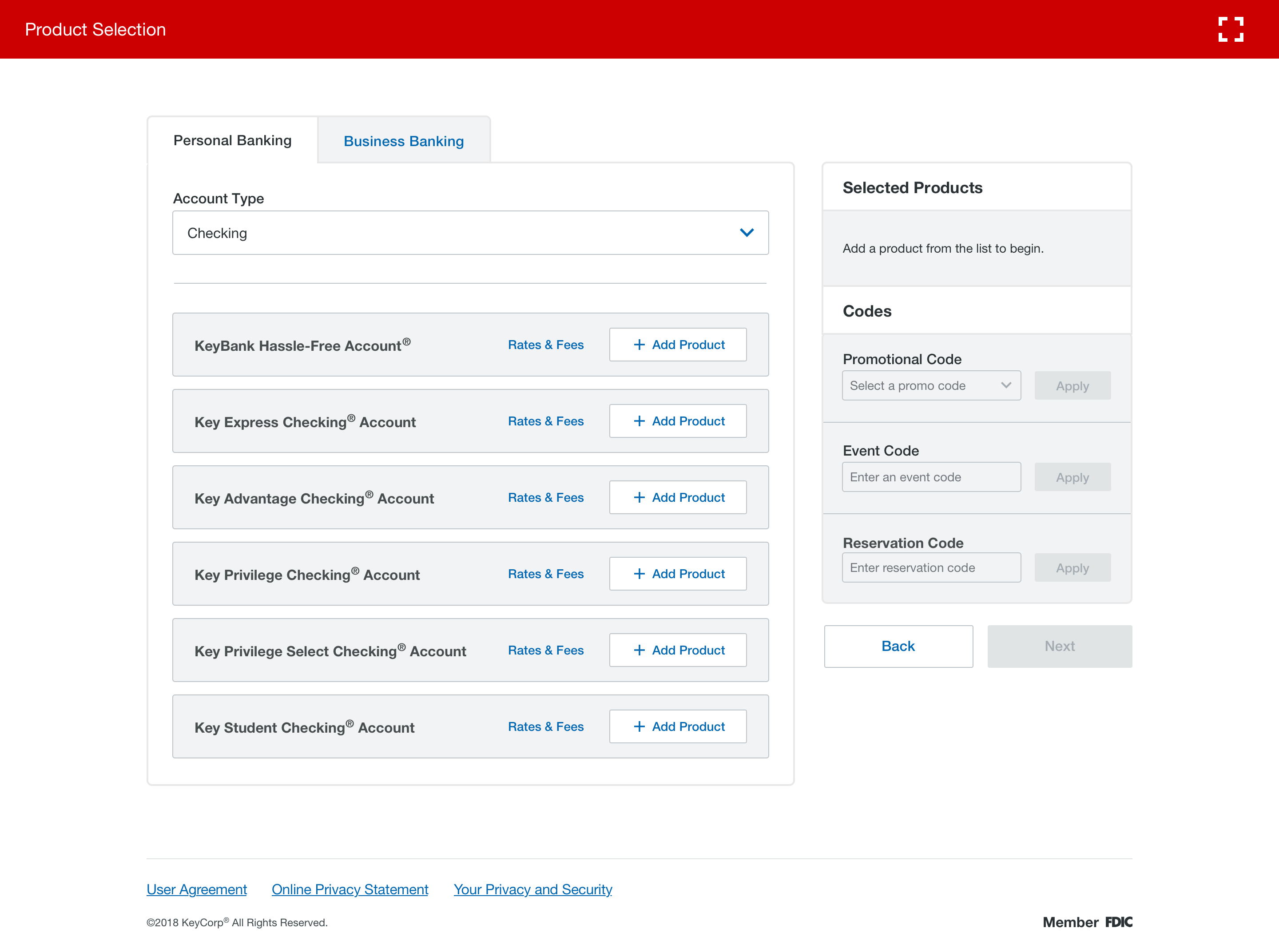

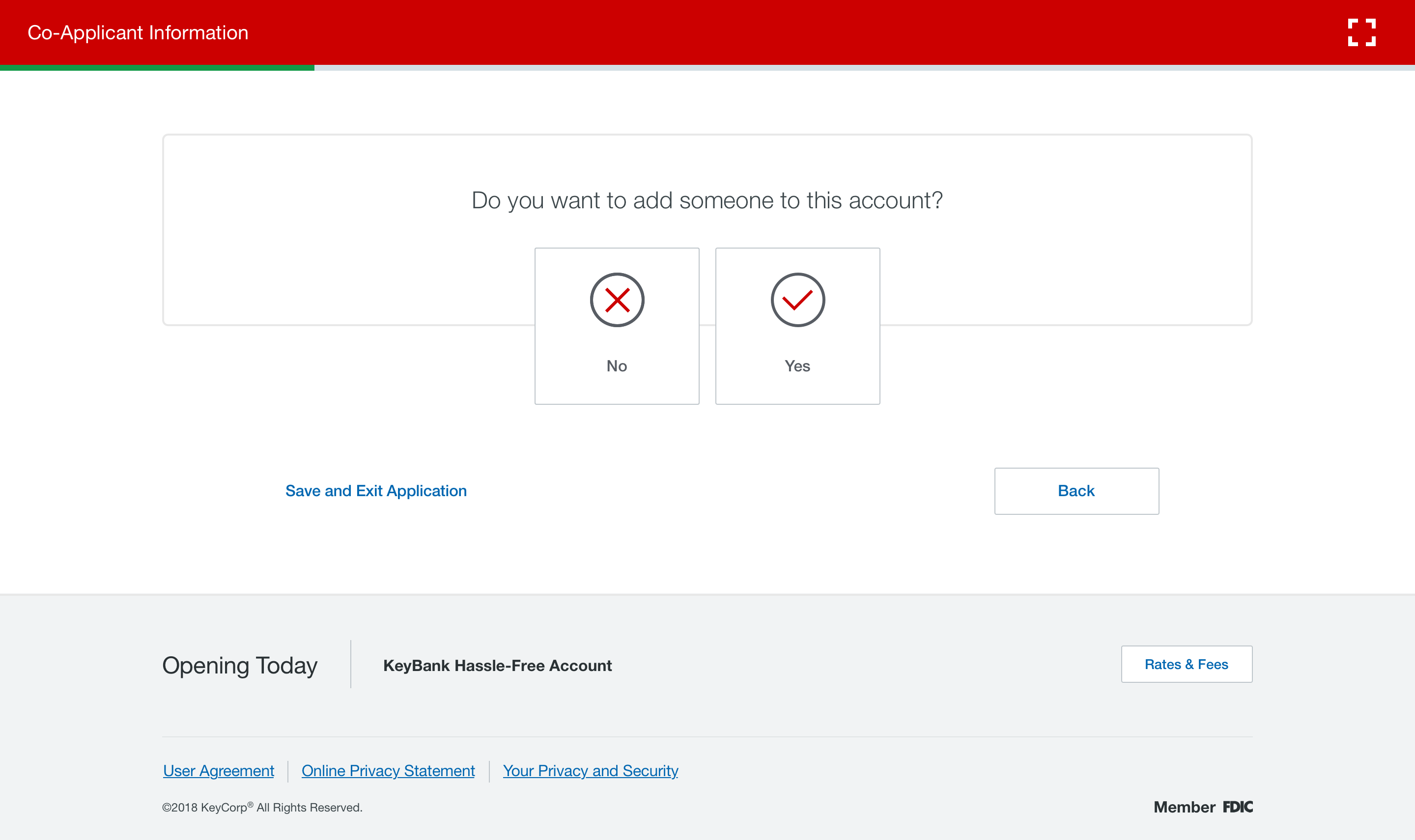

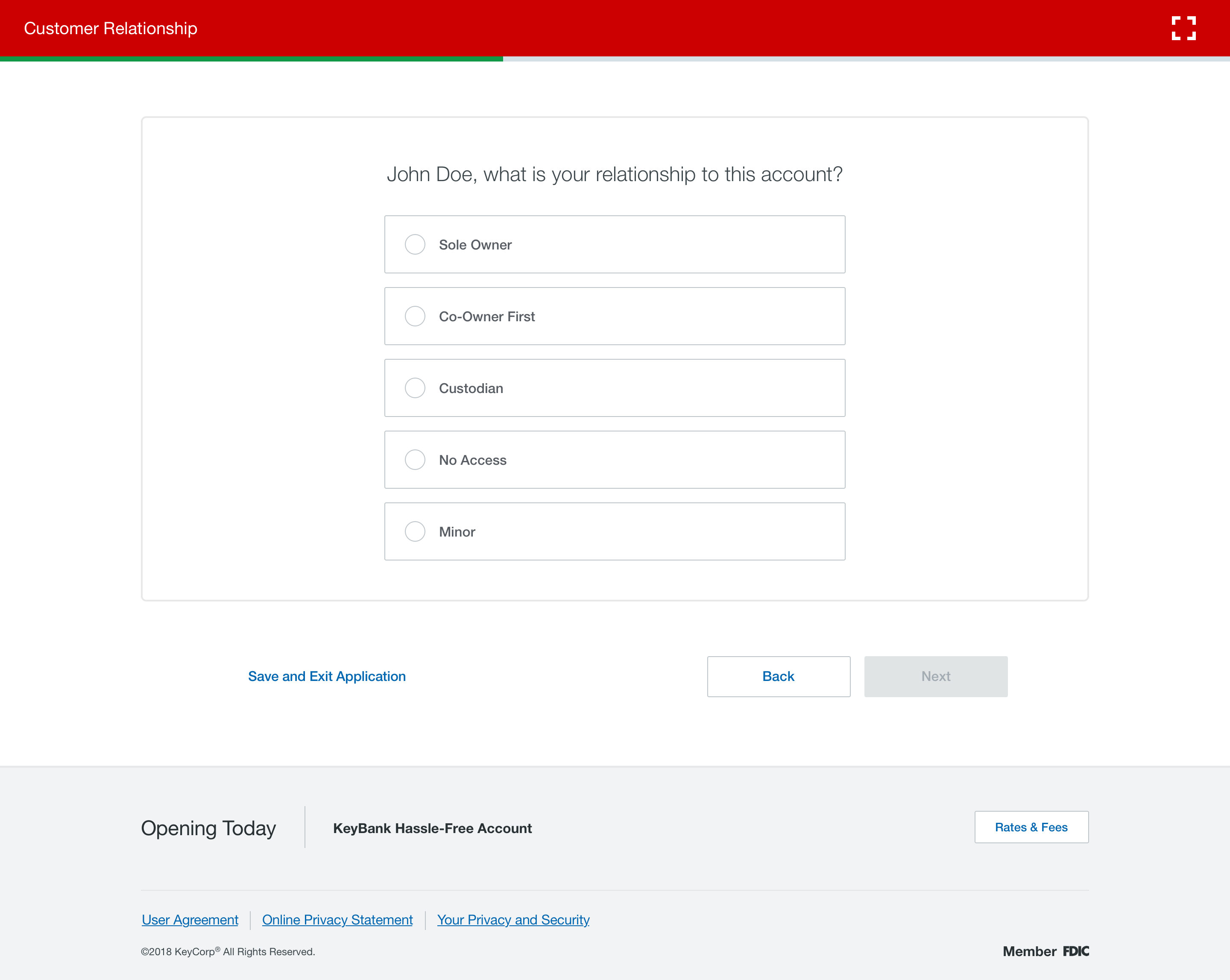

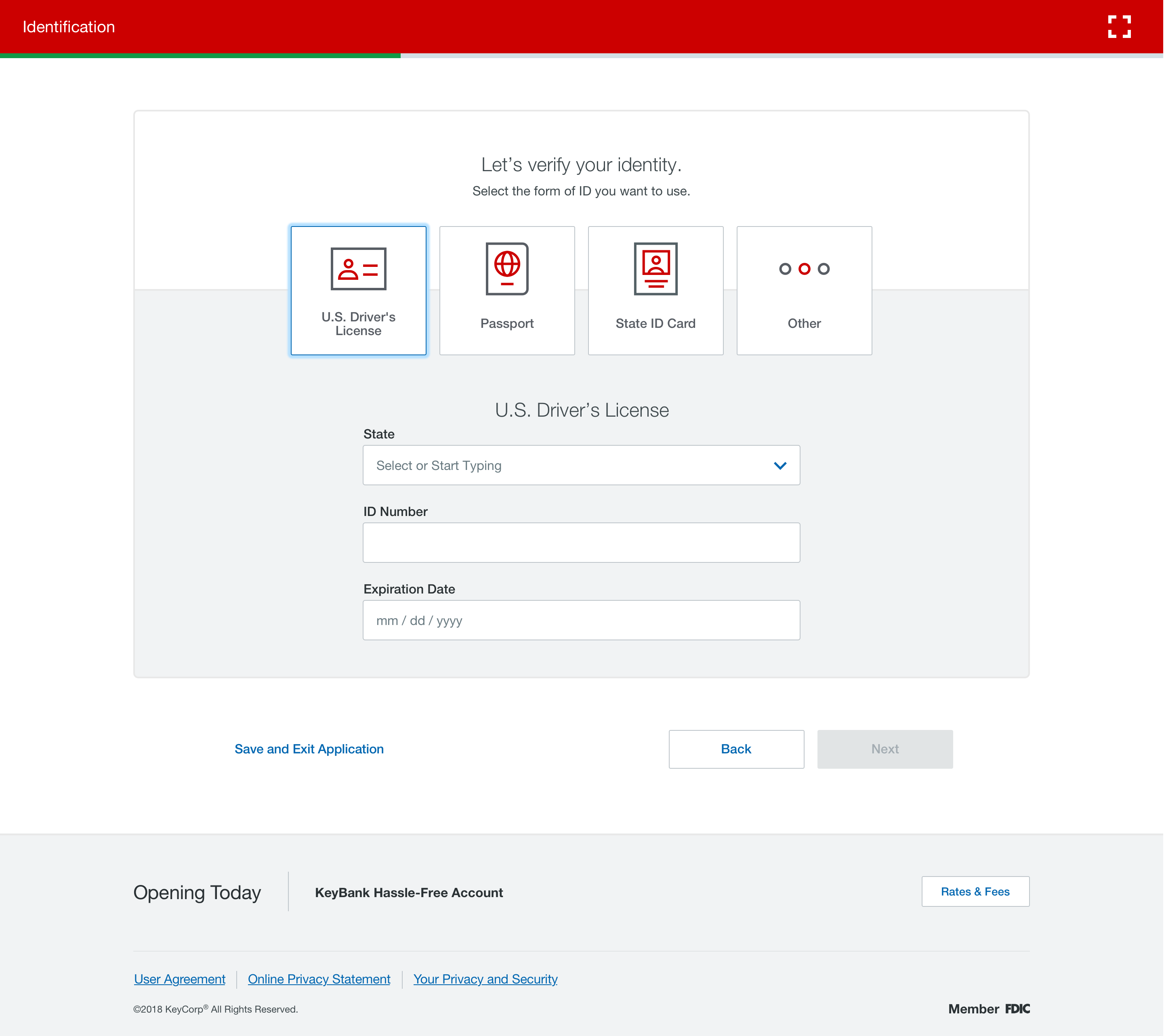

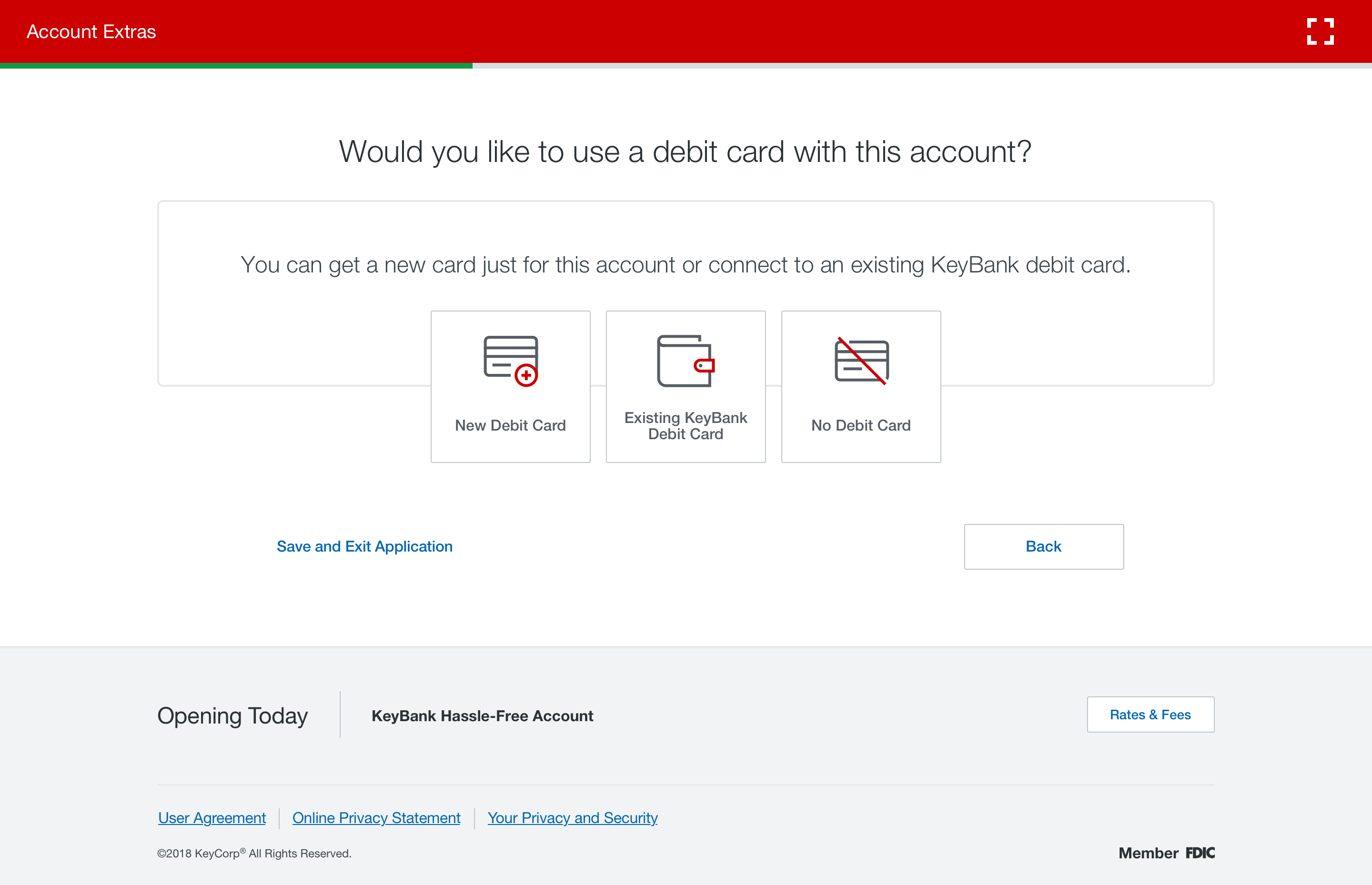

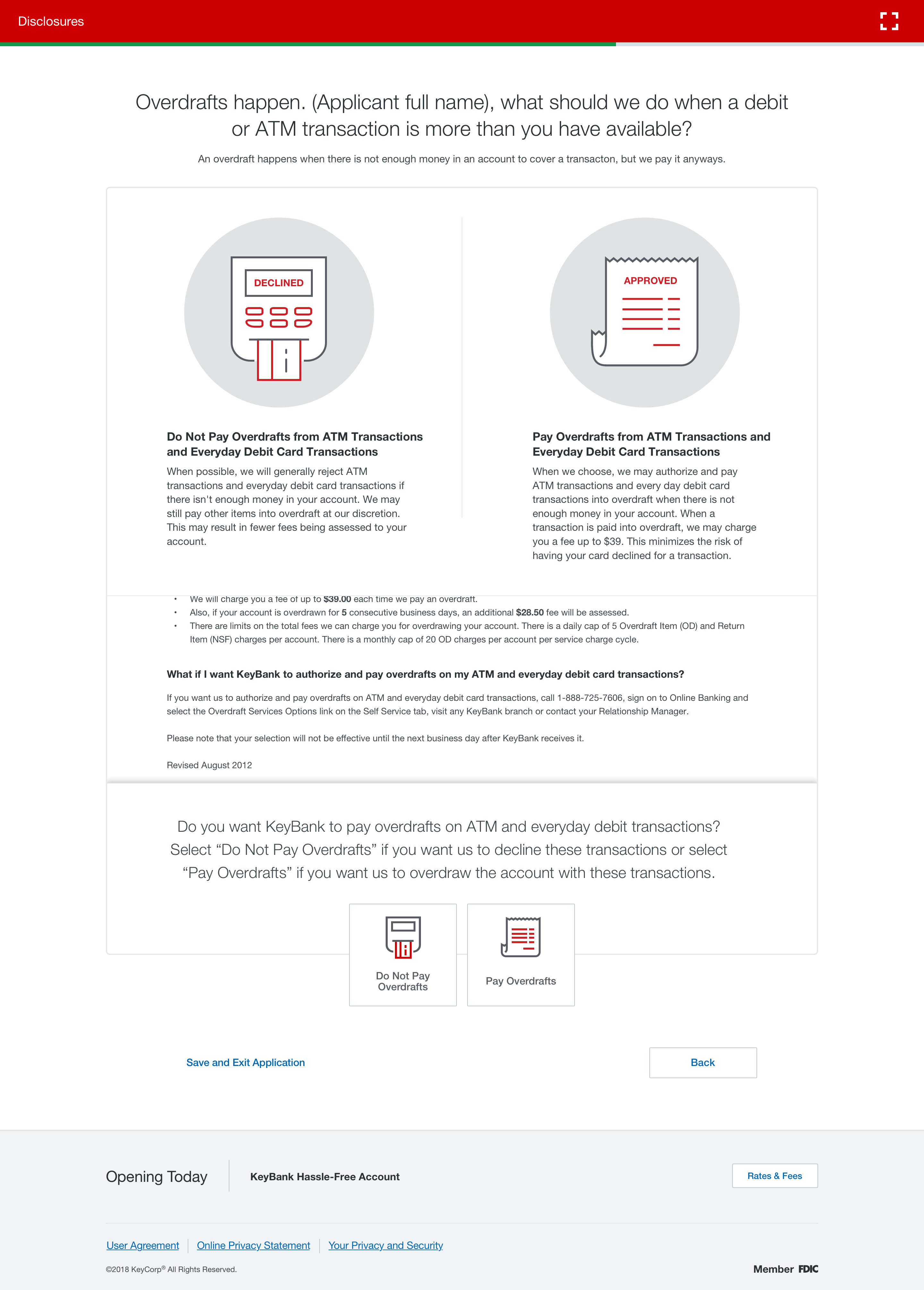

Given Keybank's ask to create a proposal that can easily scale to a self-service online experience, I focused on designing for end-customers who may not have the same financial expertise as a branch associate. After analyzing competitor's account opening flows, I aligned with decision makers at Keybank to eliminate several redundant and unnecessary steps. Additionally, I proposed areas where data collection could be automated thereby saving time. With the remaining steps, I designed an experience that followed logical steps and worked with a UX writer to re-frame questions to make information collection easy and transparent. These improvements led to the following outcomes after launch:

< 5 mins

Average account opening time

Goal: <15 mins

88%

Reduction in account opening time

4 contracts

Awarded by Keybank

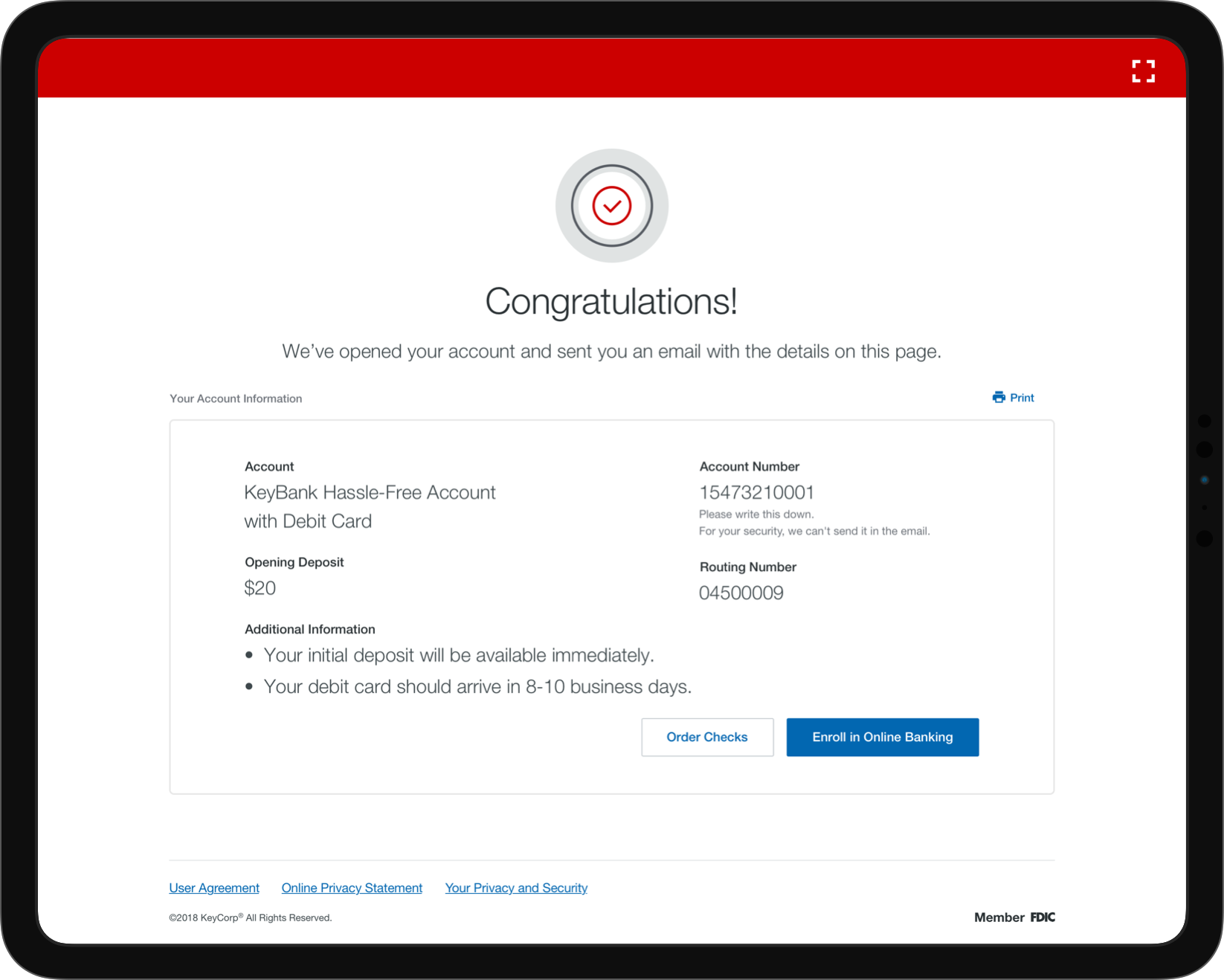

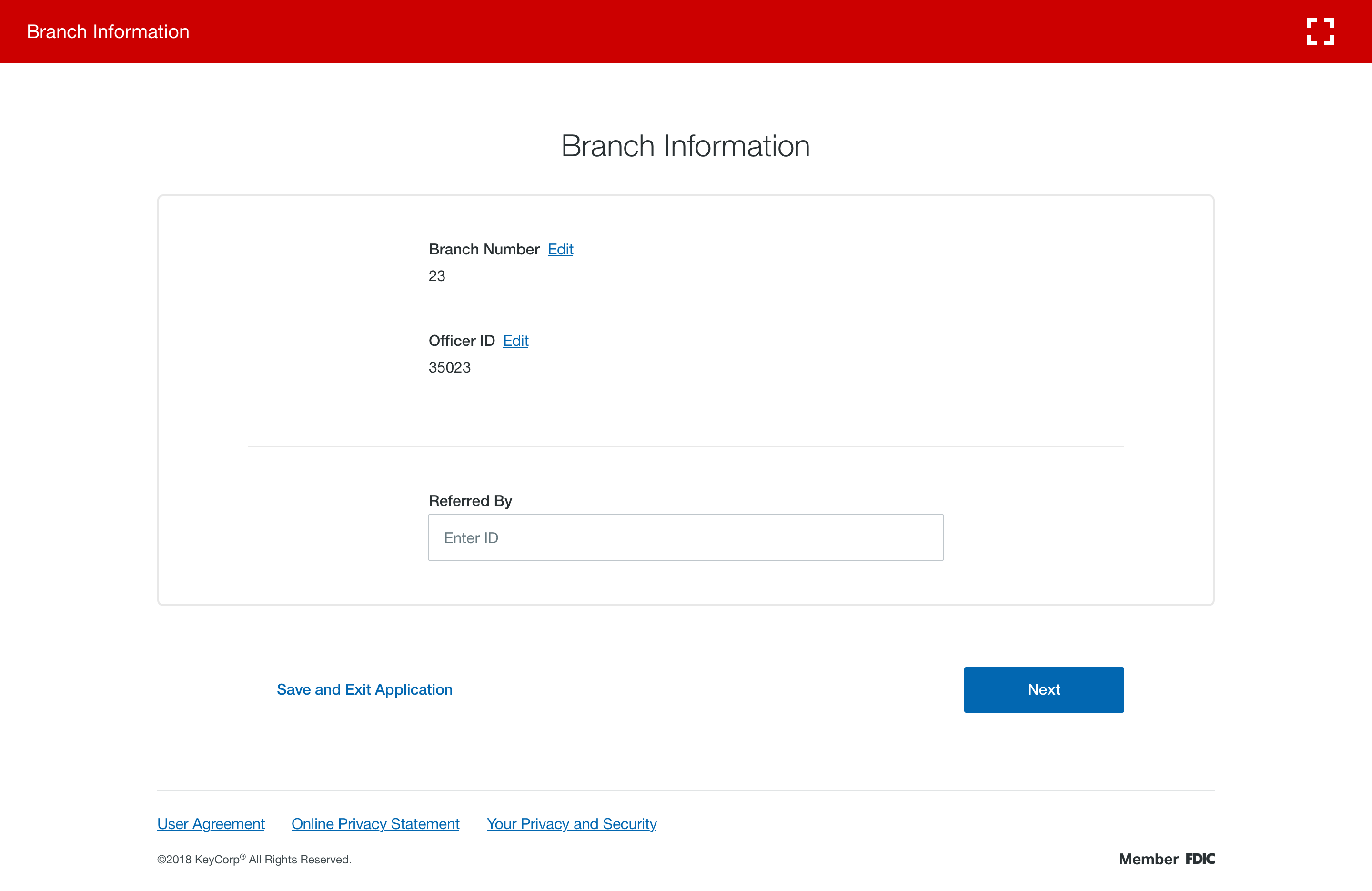

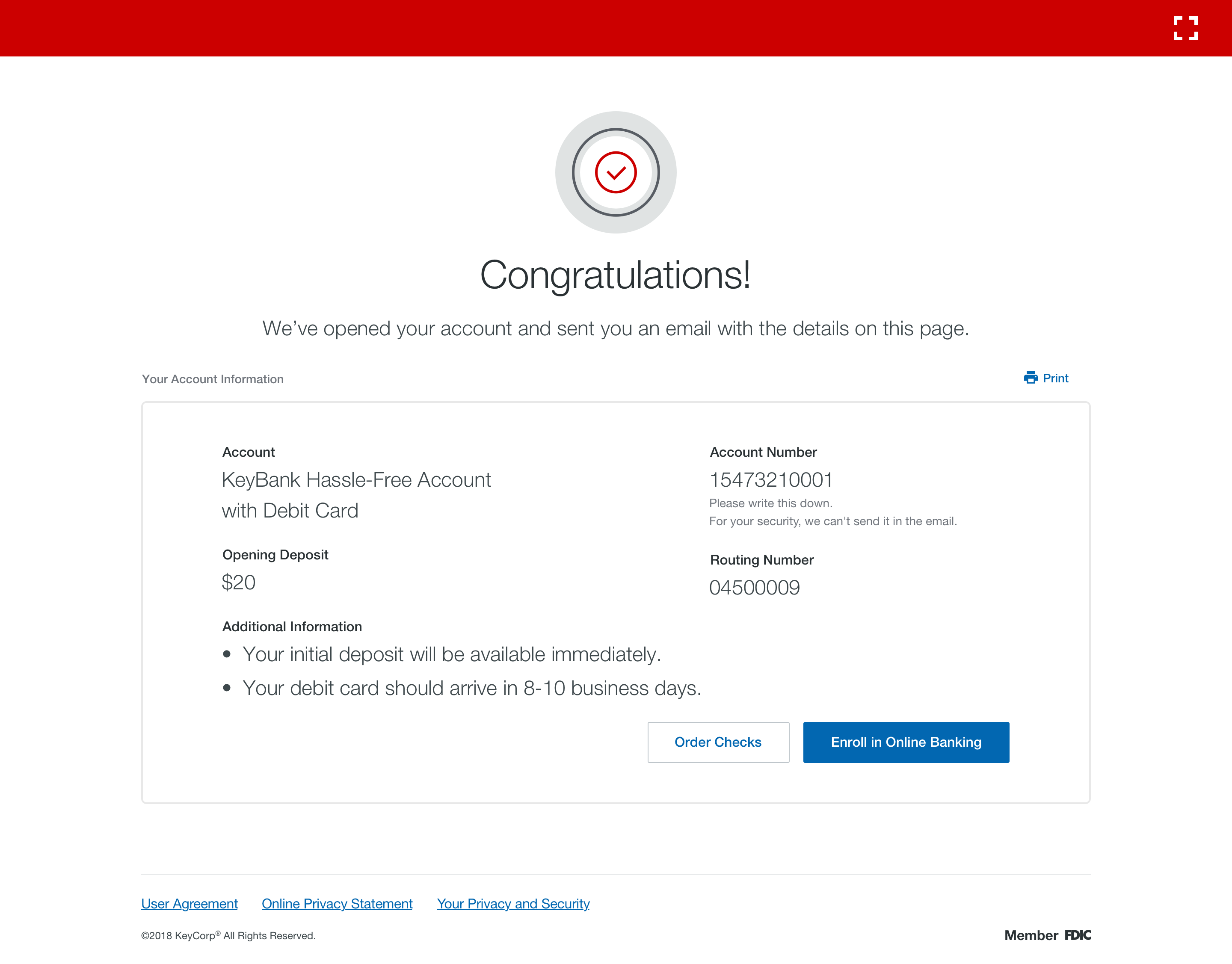

Some screenshots of final UX proposal.

📝 Note: This page shows only parts of the project. In-depth/sensitive details and end-to-end UX can be covered in person or during the interview process.